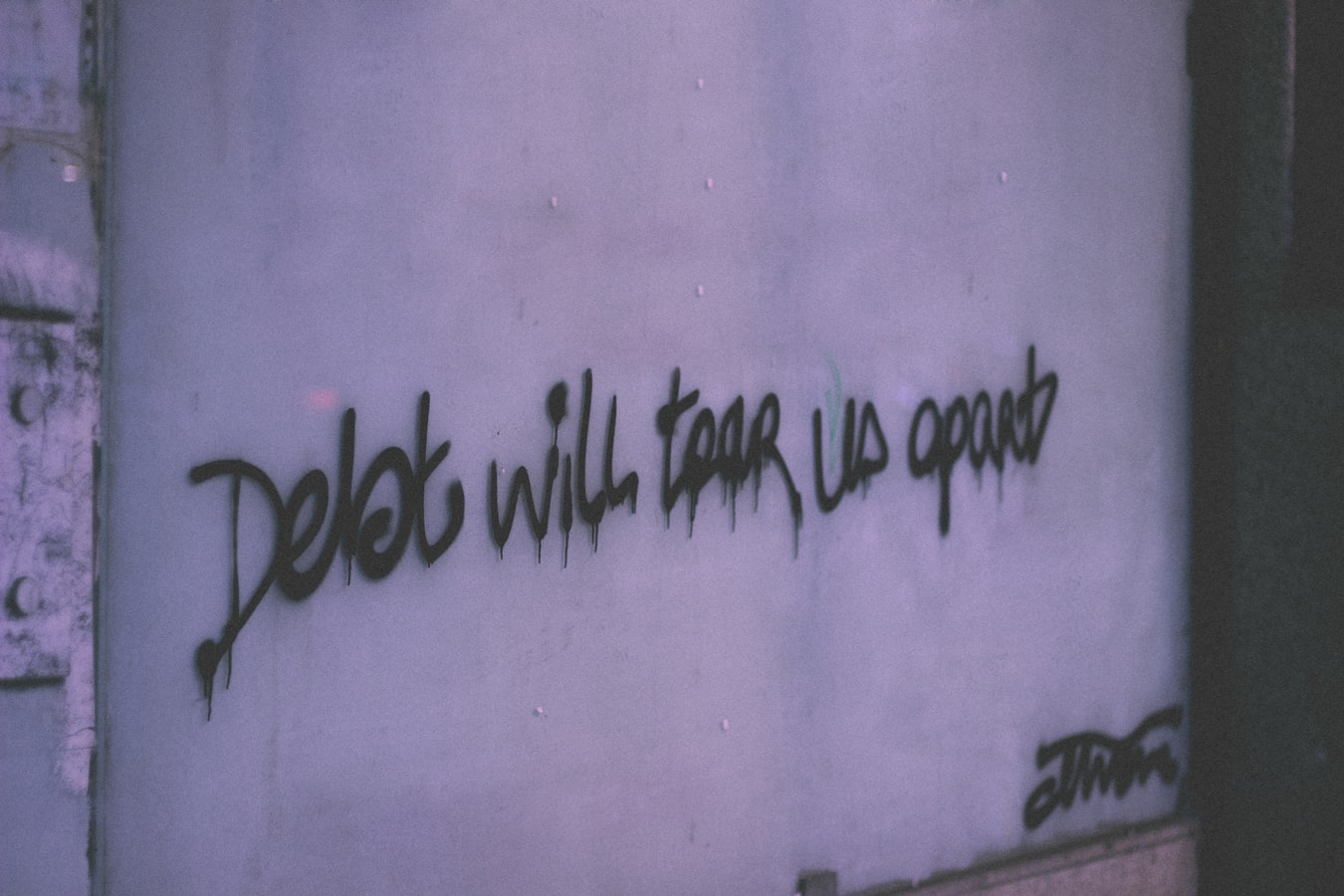

You don’t want to be in debt. That’s the commonly accepted point of view; after all, the negative connotations alone warrant people’s fears over ‘debt.’ But what if debt wasn’t some evil ball and chain but a tool for the savvy to build long term wealth? What if some debt was actually good?

Some debt is not good. Crippling interest rates are never good; credit card debt is undesirable so are microloans and services like After pay and Zip-pay. While it might sound like an oxymoron, good debt is very real. Good debt separates itself from bad debt in what it can offer you long term.

Taking on credit card debt or personal loan debt is sometimes necessary, but in the end, you are paying more money in interest and fees. Good debt, like a cheap home loan, is beneficial long term, as you are buying into something that is out of your price range through savings alone.

Higher Education Debt

A great example of good debt is a student loan. While you are in debt for a long time, the repayments are manageable, and you are gaining something far more valuable in the long term. Having an education is priceless, giving you opportunities in life that may have passed you by if you had said ‘pass’ to higher education.

Home loan

As mentioned above, a home loan is a very beneficial debt to have. Not only are you buying an asset, but you will improve your credit rating. While a mortgage might sound scary, with the right lender and the best home loan, you are buying into a piece of your future.

Taking out a home loan gives you collateral. If the unthinkable happens and you are unable to make repayments, your home can be sold off instead, leaving you free from crippling life long debt. A home represents stability and security, something that a credit card loan won’t give you!

Investment

Taking on a mortgage isn’t just for people looking to own their own home; it can be an excellent way for you to invest now, with little capital and small repayments. Taking out an investment loan can not only increase your credit score but build personal wealth.

Build a credit score.

As we have established, some debts are better than others, but all debts will have the advantage of building your credit score. A credit score is a record of responsible repayment of debt, meaning the more debt you successfully repay, the better your score becomes.

A high credit score will not only increase your chances of being approved for finance but will reduce the rates of repayment. An individual with a high credit rating can save thousands of dollars a year on repayments compared to someone who has a low credit score.

Too much debt?

It is frighteningly easy to run up bad debts today. From loose lending standards on credit cards to monstrous interest rates on microloans, its no wonder so many people are stuck with bad debt. But don’t fret! A debt consolidation loan may be your savior. A debt consolidation loan can pay off high interest (bad) debts, and allow you to make smaller, more manageable payments. Even if you are in a load of debt, there are ways out.

Debt might sound like the boogeyman, but as you can see, debt can serve a useful purpose. A home loan represents the best value, and in most cases, will leave you well on top after your debt is repaid. Most loans will boost your credit score and make loans cheaper for you in the future. Not all debt is bad, but it’s even better to avoid it all together.

Leave a Reply